Happy birthday Canada!

On behalf of Hive Advisory Inc. (HIVE) and the entire HIVE Network, wishing everyone a safe upcoming Canada Day weekend!

Best wishes and good health to you and yours.

-Hive Advisory Inc.

On behalf of Hive Advisory Inc. (HIVE) and the entire HIVE Network, wishing everyone a safe upcoming Canada Day weekend!

Best wishes and good health to you and yours.

-Hive Advisory Inc.

On behalf of Hive Advisory Inc. (HIVE) , Hive Partners and management team, as well as the entire HIVE Network, wishing everyone a Happy Easter Weekend!

Best wishes and good health to you and yours.

-Hive Advisory Inc.

As HIVE’s success lies in providing real value; experienced advice; and formidable service to HIVE Clients, we thank the many supporters for their continued interest into 2025 !

- Hive Advisory Inc.

Poor financial forecasting doesn’t just mean you miss targets; it drains resources, creates inefficiencies, and stifles growth. By adopting smarter forecasting practices, you can unlock greater financial control and guide your company toward sustainable success. Accurate financial forecasting is essential for organizational stability and growth.

Inaccurate forecasting can have severe consequences that extend beyond simple miscalculations, impacting cash flow, resource allocation, and strategic decision-making. The following suggestions from Hive Advisory Inc. (“HIVE”) examines the often-overlooked costs associated with poor financial forecasting and presents actionable strategies for improvement. By understanding and mitigating these risks, businesses can enhance their financial health and ensure long-term viability

Here are some hidden costs of inaccurate forecasting and how you can improve it to keep your business on track:

Cash Flow Disruptions

Missed revenue or expense forecasts can leave businesses scrambling for liquidity or sitting on excess cash. Either situation can lead to missed growth opportunities or emergency funding measures, which come with high interest rates or penalties.

Inventory Management Issues

Underestimating demand leads to stockouts, while overestimating leads to excess inventory—both scenarios hurt profitability. Excess inventory ties up working capital, while stockouts damage customer satisfaction and loyalty.

Misaligned Resource Allocation

If forecasts don’t match reality, businesses may hire too many (or too few) employees, over-invest in equipment, or allocate marketing dollars inefficiently. These decisions inflate costs and reduce overall efficiency.

Delayed Strategic Decisions

Inaccurate forecasting delays crucial decisions like expanding into new markets or launching new products. Leaders often hesitate to act when they can’t trust the numbers—slowing down growth and letting competitors get ahead.

Increased Cost of Capital

Poor forecasting can lead to last-minute borrowing, often at unfavorable interest rates. It can also erode investor and lender confidence, making future financing more expensive or difficult to secure.

Regulatory and Compliance Risks

Inaccurate financial projections can result in missed tax payments, non-compliance with debt covenants, or inaccurate financial reporting. These missteps can lead to fines, legal issues, and reputational damage.

Eroded Stakeholder Trust

Investors, board members, and executives rely on forecasts to make informed decisions. Frequent inaccuracies can diminish confidence in leadership, affecting stock price, investor relations, and internal morale.

Operational Inefficiencies

From supply chain disruptions to inefficient production scheduling, poor forecasting creates bottlenecks that drive up costs and reduce productivity—negatively impacting profitability.

Higher Employee Turnover

Workforce planning based on flawed forecasts can lead to hiring freezes, sudden layoffs, or overworked teams. This uncertainty can hurt employee morale and lead to increased attrition, recruitment costs, and lost institutional knowledge.

Here’s some of the ways one can improve their forecasting process:

Use Historical Data Effectively

Don’t rely solely on past performance. While it’s valuable, combine it with market trends and forward-looking data to create a more holistic forecast.

Engage with all Departments

Your sales, marketing, operations, and finance teams all have insights that impact financial performance. Regularly align your forecasts with input from all functions for a well-rounded picture.

Leverage Technological Solutions

Automated forecasting tools can reduce human error, analyze larger datasets, and identify trends that might otherwise be missed. Invest in systems that provide real-time updates and predictive analytics.

Implement Scenario Planning

Don’t rely on a single forecast. Prepare for multiple outcomes—best case, worst case, and most likely case. This approach helps you navigate uncertainty with confidence.

Monitor and Adjust Regularly

Forecasting is not a one-time exercise. Continuously track actual performance against projections and refine your forecasts based on new data, market shifts, and unexpected changes. Identify variances, analyze the reasons behind them, and adjust your forecasting models accordingly. This iterative process improves accuracy over time and allows you to react quickly to changing conditions.

Focus on Key Drivers

Identify the most significant factors that influence your forecasts. Instead of trying to predict everything, concentrate on the variables that have the largest impact. This simplifies the process and allows you to allocate resources effectively to gather the most relevant data.

Hive Advisory Inc. (“HIVE”) is a Canadian non-traditional management consulting firm designed to develop and expand a network of highly skilled and experienced, certified, independent and trained management consultants (Hive Advisors) that specialize across various service lines and industry sectors. HIVE brings a network of expert advisors with years of experience and knowledge to help today’s CFOs and CEOs overcome challenges standing in the way of their growth and strategic goals.

Now more than ever, Canadian companies need to be strategic in their decision-making, particularly when it comes to securing professional advisory and consulting services. This is a time for resilience, resourcefulness, and a renewed focus on supporting Canadian talent. At Hive Advisory Inc. (“HIVE”), we understand the complexities of this evolving economic climate. As a fully Canadian-owned advisory and consulting firm, we're deeply invested in the success of Canadian businesses. Our network of Hive Advisors, the majority of whom are independent Canadian professionals, provides a wealth of expertise across diverse industries. We believe this local perspective is invaluable in navigating the current challenges.

Many Canadian businesses are understandably wary of engaging US-affiliated or owned professional services firms. The current trade tensions raise legitimate concerns about potential conflicts of interest and the prioritization of Canadian business needs. Choosing a Canadian professional services firm (e.g., legal firm; consulting; accounting; etc.) ensures that your interests as a Canadian company are always put first. At HIVE we're committed to fostering growth within our own economy and understand the nuances of the Canadian market intimately.

Why choose a Canadian firm like HIVE in these uncertain times?

Alignment of Interests: Our focus is exclusively on the success of Canadian businesses. We understand the specific challenges and opportunities within the Canadian market and are dedicated to helping you thrive.

Local Expertise: Our network of Hive Advisors comprises experienced Canadian professionals with deep roots in the community. They possess a firsthand understanding of the Canadian business environment, regulations, and cultural landscape.

Supporting Canadian Economy: By choosing HIVE, you're directly contributing to the growth of the Canadian economy. We believe in reinvesting in our local talent and fostering a strong and resilient business community.

Mitigating Risk: In the current climate of trade tensions, choosing a Canadian firm mitigates potential risks associated with cross-border engagements. You can be confident in our commitment to your business and our understanding of the Canadian regulatory framework.

Building Long-Term Partnerships: We're not just consultants; we're partners. We're committed to building long-term relationships with our clients, working collaboratively to achieve their strategic objectives.

The current trade landscape demands a strategic and considered approach. Choosing Canadian professional services firms like HIVE is not just a sound business decision; it's an investment in the future of the Canadian economy. We encourage Canadian businesses to prioritize local expertise and support Canadian talent. Contact us today to learn how HIVE can help your business navigate these challenging times and achieve sustainable growth.

Hive Advisory Inc. (“HIVE”) is a Canadian non-traditional management consulting firm designed to develop and expand a network of highly skilled and experienced, certified, independent and trained management consultants (Hive Advisors) that specialize across various service lines and industry sectors. HIVE brings a network of expert advisors with years of experience and knowledge to help today’s CFOs and CEOs overcome challenges standing in the way of their growth and strategic goals.

As the HIVE network of advisors continues to expand its services to meet evolving client needs, this role ensures that HIVE clients benefit from expert-level financial reporting, complex accounting and CFO outsourcing solutions (“FC&CFO”). The FC&CFO practice provides businesses with access to experienced, high-caliber CFOs, CPAs and finance professionals who deliver strategic financial and accounting leadership and trouble-shooting.

Stephen's appointment highlights HIVE's commitment to delivering tailored and impactful solutions. With over 30 years of experience in financial leadership roles, Stephen brings an exceptional ability to drive financial strategy, optimize performance, and navigate complex challenges across various industries.

Stephen has been a key member of the HIVE network since 2019, contributing to the successful execution of financial strategies for clients in diverse sectors. Stephen is currently the CFO of Kuya Silver Corporation through HIVE and his previous roles included serving as Principal Officer and Chief Financial Officer for the Canadian operations of a global bank, where he oversaw financial reporting, planning, forecasting, and strategic decision-making. Stephen’s expertise also extends to finance transformations, business integrations, and creating value through actionable insights.

Stephen also brings significant experience in the Canadian banking sector in both domestic and foreign based banks with prior experience in both the technology and manufacturing spaces. As CFO of a foreign bank’s operations in Canada, Stephen has extensive experience in financial matters including reporting, planning, forecasting, strategic decision making, new business entity creation, integrations and finance transformations. After a strategic decision was made for the Global Bank to exit Canada, Stephen became Principal Officer and led the project to successfully close the Canadian operations ensuring compliance with appropriate regulatory and legal requirements.. Stephen is a Chartered Professional Accountant (CPA) and also holds certifications for the Partners, Directors and Officers exam, Chief Financial Officers Qualifying exam and Chief Compliance Officer qualifying exam from the Canadian Securities Institute.

“We are excited to welcome Stephen Peters as the Practice Head for our financial reporting, complex accounting & CFO outsource services. His deep financial expertise and leadership will ensure that our clients receive unparalleled value and strategic guidance.”

- Stefan Piech, HIVE CEO and Managing Partner

“HIVE has built its reputation as a trusted partner by providing exceptional service. Stephen’s appointment reinforces our dedication to delivering cost-effective, high-impact financial reporting, accounting & CFO outsourcing services that drive results for our clients.”

- Jeff Swinoga, HIVE President & Partner

Hive Advisory Inc. (“HIVE”) is a Canadian non-traditional management consulting firm designed to develop and expand a network of highly skilled and experienced, certified, independent and trained management consultants (Hive Advisors) that specialize across various service lines and industry sectors. HIVE brings a network of expert advisors with years of experience and knowledge to help today’s CFOs and CEOs overcome challenges standing in the way of their growth and strategic goals.

Hive Advisory Inc. (HIVE), HIVE Partners and the HIVE Network wishes everyone a happy and safe holiday season, as well as all the best for 2025 !

As HIVE’s continued success lies in providing real value; experienced advice; and formidable service to HIVE Clients, we also need to thank the many supporters over the last year, as well as their continued interest into 2025 !

- Hive Advisory Inc.

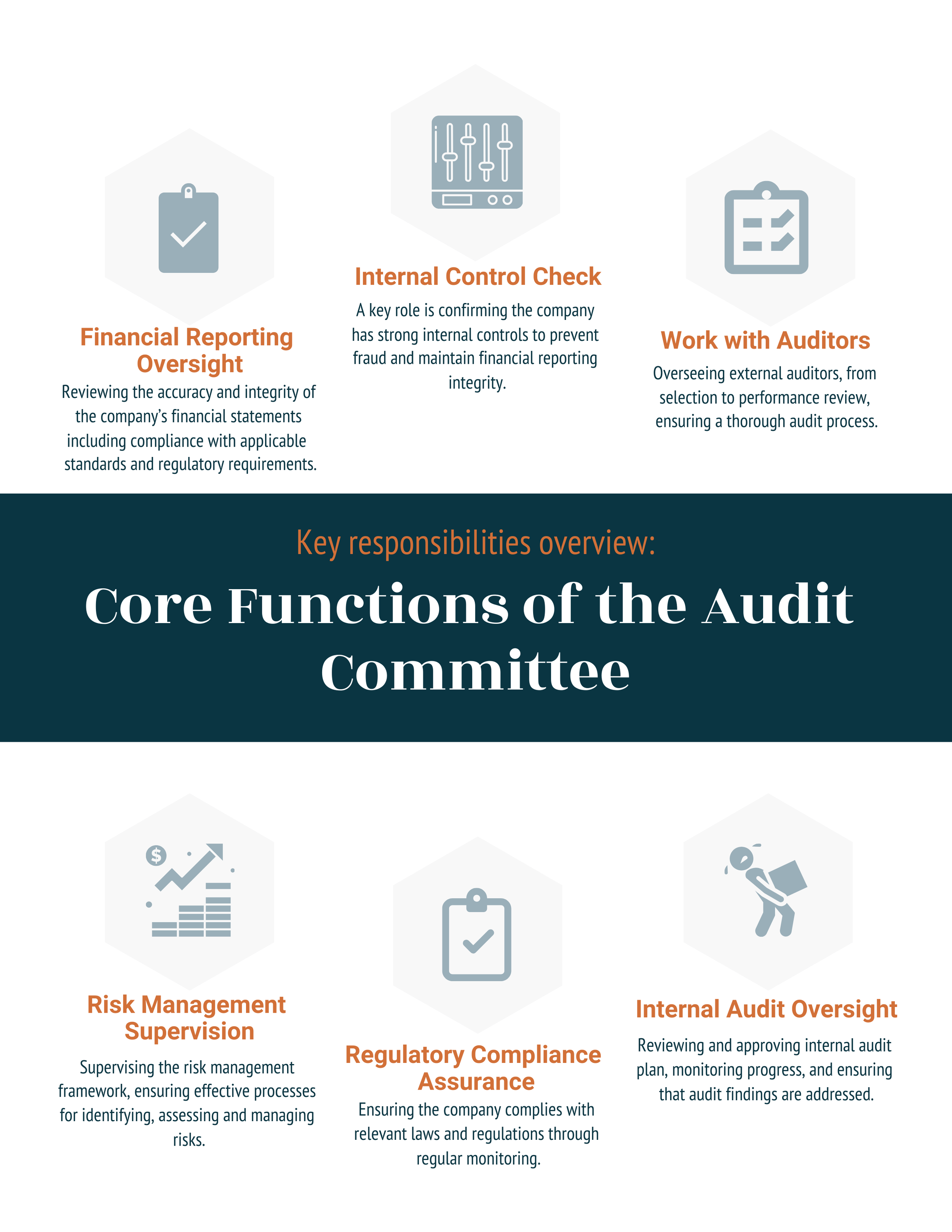

Taking on the role of Chair of the Audit Committee or becoming a new member for the first time can be both an exciting and challenging opportunity. The Audit Committee plays a crucial role in overseeing the integrity of a company’s financial reporting, internal controls, risk management, and compliance. The decisions made within the committee can have a profound impact on the financial health and governance of the organization.

Whether you're stepping into the Chair role or joining the committee as a member, understanding your responsibilities, knowing what to focus on, and following best practices are critical to your success and to the overall performance of the committee. This article outlines the key considerations, recommendations, and best practices for anyone taking on an Audit Committee role for the first time.

Here are some key considerations and recommendations for stepping into this role:

Your leadership will set the tone for the committee’s effectiveness. Here are some best practices to follow:

The first time can be a steep learning curve, but it also offers the opportunity to have a significant impact on the company’s financial integrity and governance. By understanding your responsibilities, building strong relationships with key stakeholders, and focusing on core financial and compliance issues, you can contribute to the success and stability of the company.

Need assistance in ensuring your Audit Committee is effective and well-prepared? Contact us today for guidance on improving your financial governance and internal controls.

Exciting News at Hive Advisory! Over the past few months, we've been growing our team with exceptional professionals, each bringing unique expertise and experience that strengthens our ability to serve our clients. Please join us in welcoming Alejandro Minuto, Joe Filippelli, and Ellen Lee to Hive Advisory Inc. (“HIVE”)!

We are delighted to introduce Alex Minuto, a seasoned risk and controls expert with a proven track record in leading complex projects across various industries. He also brings 14 years in mining with Barrick Gold Corporation where he held a local board member position and led from its inception the financial compliance programs for the South America region. His extensive experience with top-tier multinational corporations and his holistic business vision will be invaluable in enhancing our client’s corporate governance processes.

We are excited to introduce Grace Mutahi, a highly experienced risk management and internal audit advisory expert with over 18 years of experience . She has a proven track record leading complex projects and delivering key insights to senior executives and audit committees at major financial institutions, including Bank of Montreal, Scotiabank, TD Bank, and Citibank. Grace also played a key role in large-scale transformation projects for several federal government departments, such as the Treasury Board Secretariat and Health Canada. Her expertise in internal audit, risk assessment, and control design, coupled with her CIA designation and MBA in Finance, will be instrumental in providing our clients with exceptional service and tailored solutions.

Joining us is Joe Filippelli, a seasoned finance professional specializing in financial governance, internal audit, and risk management. With over 15 years of client service experience in industries such as financial services, mining, and environmental services, Joe has a strong track record of leading governance and risk engagements. His expertise in designing effective solutions and delivering impactful outcomes will greatly benefit our clients.

We also welcome Ellen Lee, a Senior Finance and Operations Executive with a strong foundation in operational review, financial reporting, and corporate governance across various industries. Recognized for bringing innovative solutions to a variety of business and performance issues, Ms. Lee has been valued for developing strong relationships and effectively leading cross-functional teams. Her proven leadership and technical skills will be instrumental in guiding our clients through complex changes.

At Hive Advisory, we are committed to providing exceptional cost-effective services to our clients. With the addition of these talented professionals, our capabilities have expanded, enabling us to deliver even greater value. If you're seeking expert guidance and innovative solutions, please contact us to learn how we can assist you.

Hive Advisory Inc. (HIVE), HIVE Clients and the HIVE Network had a great time at HIVE’s end of summer Meet & Greet at Beer Bistro!

Many thanks to all who attended !

-Hive Advisory Inc.

As HIVE’s success lies in providing real value; experienced advice; and formidable service to HIVE Clients, we thank the many supporters for their continued interest into 2024 !

- Hive Advisory Inc.

Big thanks to Clifton Blake Asset Management for organizing this incredible event at The Monarch Tavern. The music was fantastic, and it felt great to contribute to such important causes in our community.

Fred Victor is a leader in ending homelessness in Toronto, and Project Canoe empowers youth through outdoor adventure.

We're proud to stand with them!

Shout out to the other sponsors, Studio JCI, Silvercreek Commercial Builders, and Roseander Main. Together, we can make a difference!

Hive Advisory Inc. (“HIVE”) is a Canadian non-traditional management consulting firm designed to develop and expand a network of highly skilled and experienced, certified, independent and trained management consultants (Hive Advisors) that specialize across various service lines and industry sectors. HIVE brings a network of expert advisors with years of experience and knowledge to help today’s CFOs and CEOs overcome challenges standing in the way of their growth and strategic goals.

As the Hive Advisory Inc. (“HIVE”) Network continues to grow and evolve, we are proud to announce the expansion of our services to include increased specializations for modelling and data analytics services to businesses of all sizes.

Our services take a collaborative approach to working with our clients, partnering with them to understand their unique needs and challenges. We then leverage our deep industry knowledge and expertise to develop customized solutions that deliver real results.

HIVE offers a comprehensive suite of financial and data modelling services, catering to the evolving needs of modern businesses. From crafting bespoke financial models and performing rigorous assessments to conducting sensitivity analyses and forecasting revenue, HIVE empowers clients with the tools to make informed decisions.

Additionally, HIVE's expertise extends to data modelling and analytics, encompassing data model evaluations, risk quantification, and in-depth data analysis. HIVE goes beyond mere modelling and analysis, offering training programs and technical proficiency in macro development, SQL, Python, and VBA coding, ensuring clients can leverage data effectively and build internal capabilities.

Our modelling and data analytic services take a collaborative approach to working with our clients, partnering with them to understand their unique needs and challenges. We then leverage our deep industry knowledge and expertise to develop customized solutions that deliver real results!

-Hive Advisory Inc.

Hive Advisory Inc. (“HIVE”) is a Canadian non-traditional management consulting firm designed to develop and expand a network of highly skilled and experienced, certified, independent and trained management consultants (Hive Advisors) that specialize across various service lines and industry sectors. HIVE brings a network of expert advisors with years of experience and knowledge to help today’s CFOs and CEOs overcome challenges standing in the way of their growth and strategic goals.

As HIVE continues to expand and address increasingly complex client needs, it has established this pivotal role to ensure HVE Clients receive unparalleled expertise and strategic guidance in navigating the complexities of governance initiatives, internal control environments, risk management and compliance.

Juan’s appointment and acceptance to this new role underscores HIVE’s commitment to providing top-tier advisory services. With over 20 years of profound experience in strategic, financial and operational risk and governance works, Juan excels in enhancing company performance through advanced control systems, managing uncertainty, and achieving strategic objectives. His ability to lead, navigate ambiguity and reduce risk will significantly benefit HIVE Clients clients, ensuring they can confidently pursue their goals.

Juan is no stranger to HIVE ! Juan joined the HIVE Network in 2022 assisting in the execution and management of numerous mandates with HIVE Client’s in the mining, forestry and life science sectors. His previous experiences include an impressive tenure at Barrick Gold Corporation whereby Juan spearheaded the Internal Audit function across Latin America and Asia Pacific. He also was instrumental in the success of the global internal controls environment framework and evaluation program, ensuring compliance with SOX 404 (a) and NI 52-109 requirements, as well as played a key role in developing and implementing Barrick’s Enterprise Risk Management (ERM) frameworks. He is a Chartered Professional Accountant (CPA) from CPA Ontario, a Certified Information Systems Auditor (CISA) from ISACA, and a Certified Internal Auditor (CIA) from the Institute of Internal Auditors.

“We are thrilled to introduce the new role of HIVE’s Practice Head for GRC practice and equally honoured to welcome Juan into this new role within the HIVE Network. His deep expertise and leadership in internal audit, internal controls and risk management will undoubtedly strengthen our GRC practice. The creation of the Hive Practice Head within our lines of service is a testament to our commitment to excellence and innovation. Juan’s leadership will be pivotal in helping HIVE Clients navigate complexities and achieve their strategic goals with confidence and assurance.”

- Stefan Piech, HIVE CEO and Managing Partner

“HIVE’s focus is on providing outstanding service to its clients and is the reason HIVE has become a first-call advisory firm that clients trust. Juan’s new position within HIVE’s Network is granted on his leadership and top notch service recognized by HIVE Clients !”

- Jeff Swinoga, HIVE President & Partner

Hive Advisory Inc. (“HIVE”) is a Canadian non-traditional management consulting firm designed to develop and expand a network of highly skilled and experienced, certified, independent and trained management consultants (Hive Advisors) that specialize across various service lines and industry sectors. HIVE brings a network of expert advisors with years of experience and knowledge to help today’s CFOs and CEOs overcome challenges standing in the way of their growth and strategic goals.

As the HIve Advisory Inc. (“HIVE”) Network continues to grow and evolve, we are proud to announce the expansion of our services to include HIVE’s fractional CFO services to help address these challenges.

HIVE’s CFO outsource services provide you with real and experienced executive advice and guidance for your financial reporting, complex accounting, and governance requirements. We offer real named CFOs with hands-on experience to support your publicly traded or private company, as well as the support of an integrated accounting and financial reporting function to ensure accurate and timely financial reporting.

HIVE understands that financial reporting and governance requirements can be complex and time-consuming. HIVE’s advisors consist of highly experienced financial reporting and management experts, including former CFOs, controllers, and advisors with a mix of public accounting and industry experience. A HIVE outsourced CFO can supervise and lead your company's financial reporting and governance requirements; even provide advice on debt and equity financing; insurance requirements and renewal strategies; as well as mergers and acquisitions. We also offer integrated governance advisory services to ensure your business operates with best-practice levels of internal controls framework.

-Hive Advisory Inc.

Hive Advisory Inc. (“HIVE”) is a Canadian non-traditional management consulting firm designed to develop and expand a network of highly skilled and experienced, certified, independent and trained management consultants (Hive Advisors) that specialize across various service lines and industry sectors. HIVE brings a network of expert advisors with years of experience and knowledge to help today’s CFOs and CEOs overcome challenges standing in the way of their growth and strategic goals.

On March 13, 2024, The Canadian Sustainability Standards Board (“CSSB”) has taken a major leap forward with the release of exposure drafts for the first Canadian Sustainability Disclosure Standards (“CSDS”) 1 (i.e., sustainability disclosure standard) and CSDS 2 (i..e, climate related disclosures). These drafts are designed to align with international standards yet address the specificities of the Canadian landscape with CSDS 1 focusing on general sustainability-related financial disclosures and CSDS 2 on climate-related disclosures.

The baseline for both of these standards are based on the June 26, 20203 international Sustainability Standards Board (“ISSB”) release of IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information lays out the general requirements for disclosing sustainability-related financial information; and IFRS S2 Climate-related Disclosures focuses on climate-related disclosures. This marks a pivotal moment for sustainability reporting in Canada.

It appears that now is the time to shape sustainability reporting standards in Canada with the exposure drafts open for feedback until June 20, 2024 to help ensure that the final standards are reflective of Canada's diverse economic and ecological landscapes.

As the Canadian landscape moves towards a more sustainable and transparent corporate environment, ensuring your organization is aligned with the evolving standards is paramount. HIVE’s ESG services are here to guide one through this transition. Our expertise in sustainability reporting and compliance will help companies not only meet any new requirements but help you excel in your sustainability efforts. Connect with HIVE today to prepare for the future of sustainability and demonstrate your commitment to a greener and more sustainable future.

HIVE’S COMMITMENT TO ESG & SUSTAINABILITY

We believe that the transformation towards ESG excellence is not only a moral imperative but also a business necessity. Our commitment to sustainability drives everything we do, and we are passionate about helping you embrace this transition.

At HIVE, we are dedicated to empowering businesses and organizations to thrive in an increasingly conscious and responsible world. We understand that Environmental, Social, and Governance (ESG) considerations are not just a passing trend but are essential for building a sustainable, resilient, responsible and competitive future for companies. The organizations of tomorrow are the ones that can turn a strong ESG performance into a competitive advantage. Our ESG services are designed to guide and support you on your journey towards ESG excellence.””

-HIVE Partners

Hive Advisory Inc. (“HIVE”) is a Canadian non-traditional management consulting firm designed to develop and expand a network of highly skilled and experienced, certified, independent and trained management consultants (Hive Advisors) that specialize across various service lines and industry sectors. HIVE brings a network of expert advisors with years of experience and knowledge to help today’s CFOs and CEOs overcome challenges standing in the way of their growth and strategic goals.

Hive Advisory Inc. (HIVE), HIVE Clients and the HIVE Network had a great time at HIVE’s Pre-PDAC Meet & Greet !

Many thanks to all who attended !

-Hive Advisory Inc.

As HIVE’s success lies in providing real value; experienced advice; and formidable service to HIVE Clients, we thank the many supporters for their continued interest into 2024 !

- Hive Advisory Inc.

As the HIVE Network’s growth continues to accelerate, servicing its clients and expanding its services, Hive Advisory Inc. (“HIVE”) is proud to announce it has expanded its service offerings to include environment, social and governance (“ESG”) services.

ESG initiatives are ever evolving and navigating through the rhetoric can be challenging. From planning your ESG strategy; understanding your ESG risks and opportunities; establishing your first ESG framework in line with recognized global standards; developing meaningful ESG KPIs; and fulfilling your potential ESG regulatory disclosure requirements…HIVE is here to help!

HIVE believes that ESG implementation should be integrated with an organization’s strategy and operational setting. The fundamental purpose of HIVE’s ESG program is to contextualize and manage an organization’s ESG goals and risks as they work towards achieving their defined organization’s mission, vision and values.

HIVE’S COMMITMENT TO ESG & SUSTAINABILITY

We believe that the transformation towards ESG excellence is not only a moral imperative but also a business necessity. Our commitment to sustainability drives everything we do, and we are passionate about helping you embrace this transition.

At HIVE, we are dedicated to empowering businesses and organizations to thrive in an increasingly conscious and responsible world. We understand that Environmental, Social, and Governance (ESG) considerations are not just a passing trend but are essential for building a sustainable, resilient, responsible and competitive future for companies. The organizations of tomorrow are the ones that can turn a strong ESG performance into a competitive advantage. Our ESG services are designed to guide and support you on your journey towards ESG excellence.””

-HIVE Partners

Hive Advisory Inc. (“HIVE”) is a Canadian non-traditional management consulting firm designed to develop and expand a network of highly skilled and experienced, certified, independent and trained management consultants (Hive Advisors) that specialize across various service lines and industry sectors. HIVE brings a network of expert advisors with years of experience and knowledge to help today’s CFOs and CEOs overcome challenges standing in the way of their growth and strategic goals.

Hive Advisory Inc. (HIVE), HIVE Partners and the HIVE Network wishes everyone a happy and safe holiday season, as well as all the best for 2024 !

As HIVE’s continued success lies in providing real value; experienced advice; and formidable service to HIVE Clients, we also need to thank the many supporters over the last year, as well as their continued interest into 2024 !

- Hive Advisory Inc.

Hive Advisory Inc. (HIVE), HIVE Clients and the HIVE Network had a great time at HIVE’s annual Fall Meet & Greet !

Many thanks to all who attended !

-Hive Advisory Inc.

As HIVE’s success lies in providing real value; experienced advice; and formidable service to HIVE Clients, we thank the many supporters for their continued interest into 2023 !

- Hive Advisory Inc.